Last Updated on April 28, 2024 by Twinbrodas

Many Nigerians presently are addicted to loans, not that it’s intentional but because of the current situation and economy of the country. Getting a loan without bvn is one of the questions those who are interested in getting loans online do ask. But before we talk about loans without bvn in Nigeria, we need to explain some basic things you need to understand.

Please when searching for loan apps to download or searching for ways to get loans without bvn, always note that there are many fake loan apps out there. You can read our previous post on the list of fake loan apps in Nigeria and also, You can read about the best loan apps in Nigeria. With that, you can be sure of the type of the loan app you are dealing with.

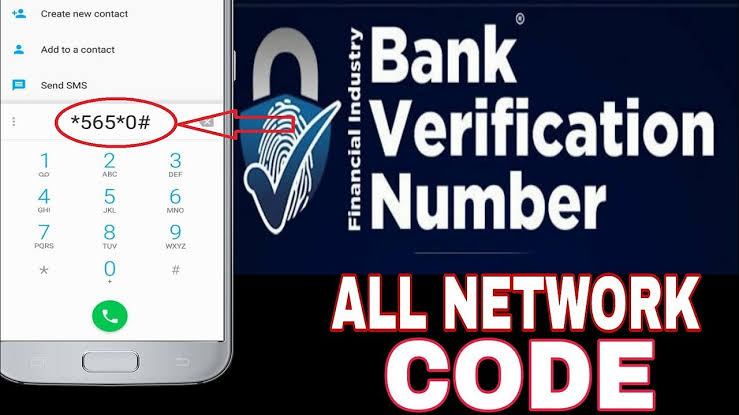

First thing you should first understand if you are thinking of loan app is that many loan apps will require users to link their Bank Verification Number (BVN) to verify their identity and creditworthiness. . Now, we know that Some people, for various reasons, may prefer not to disclose their BVN. So now the question is, Is it possible to get a loan without bvn in Nigeria?

In this article, we will explain the possibility of getting loan in Nigeria without BVN. But before that, you need to also understand how important BVN is.

Importance of BVN

Bank Verification Number (BVN) is an essential identification system implemented by the Central Bank of Nigeria to protect customers and enhance financial security. BVN serves as a unique identifier for people in the banking system. It also helps in ensuring the accuracy of personal information and reducing fraudulent activities. The inclusion of BVN verification in loan apps helps to establish the credibility and reliability of loan applicants, reducing the risk of default for loan providers.

Finding Loan Apps Without BVN

The truth is that for you to get a loan from a loan app that doesn’t ask for BVN is very difficult. Loan apps that do not ask for BVN verification are very scarce to get in Nigeria presently. The introduction of BVN has made many loan apps to come on board as they believe that BVN has minimized the risk of fraud. Many legit loan apps uses BVN verification to make sure that the identity and the information provided by the borrower when requesting for loan is correct.

Can I Get A Loan Without BVN In Nigeria Without Using Loan Apps?

Yes, you can get a loan without BVN without using loan app. We know that loan apps without BVN verification are is hard to get, there are alternative options available for people who are seriously in need of Loans.

Loans Without BVN In Nigeria

- Collateralized Loan Apps

Some loan apps in Nigeria offer borrowers the option of getting a loan by providing collateral. What this means is that the loan app may not need your bvn only a physical Collateral which can be used to recover their money if you didn’t pay their money. Collateral serves as security for the loan, With Collateral, the lender does not even need your BVN as they have already seen a physical assets to rely on. The way this loan apps operate is very simple as you will get a loan based on the Collectaral you provided. For example, If you cannot provide assets or property worth one million, you can’t get a loan that is up to that amount.

- Community-Based Lending

Another way to get loans without BVN in Nigeria is by using the Community Based Lending. How does this work? I will explain better. The community based Lending is also referred to as p2p.

Community-based lending platforms operate on a peer-to-peer lending model, connecting borrowers directly with lenders within a specific community or network. These platforms do not need BVN verification but instead rely on trust and reputation within the community. Borrowers can get loans from people who are willing to lend based on their assessment of the borrower’s credibility and willingness to repay.

- Salary Advance Apps

Salary Advance Advance Apps is another sure way to get a loan without bvn in Nigeria. These apps don’t need your BVN as you will link the app with your account number and some personal details and amount of salary you receive monthly. Sometimes, the app may create an account online for you that your salary can be transferred to once you receive your payment. With that they will be sure of the actual amount that is being paid to you. One thing about this method of getting a loan without bvn is that they can’t give you any loan that is more than the amount you receive as Salary.

Originally posted 2024-01-17 12:16:46.